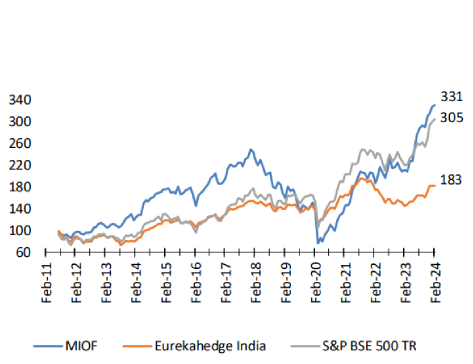

| Exhibit 2a – Metis India Opportunity Fund’s Gross Performance (USD) | ||||||||

Metis India Opportunity Fund |

Nifty TR |

S&P BSE 500 TR |

S&P BSE Midcap TR |

S&P BSE Smallcap TR |

Eurekahedge India (USD) |

India-focused CE Funds* |

||

| USD, Inception: April 2011 | ||||||||

| Trailing 1 year | -17% | 7% | 1% | -4% | -11% | 10% | -7% | |

| Trailing 3 years | 72% | 38% | 41% | 73% | 66% | 31% | 11% | |

| Trailing 5 years | 180% | 61% | 72% | 121% | 138% | 24% | -8% | |

| Since Inception TR | 257% | 200% | 229% | 326% | 277% | 102% | 18% | |

| Trailing 3-year Ann. | 20% | 11% | 12% | 20% | 18% | 9% | 4% | |

| Since Inception Ann. | 9% | 8% | 8% | 10% | 9% | 5% | 1% | |

| Sharpe Ratio from Inception | 0.36 | 0.34 | 0.36 | 0.43 | 0.37 | 0.20 | 0.01 | |

| Calmar Ratio (5-yr/3%) | 0.29 | -0.21 | 0.32 | 0.29 | 0.28 | 0.05 | -0.11 | |

| Calmar Ratio (Since Inception/3%) | 0.09 | -0.14 | 0.20 | 0.15 | 0.12 | 0.07 | -0.05 | |

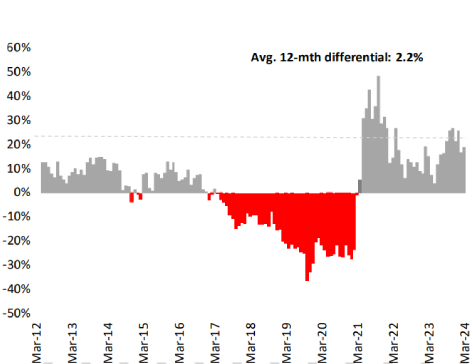

Note: *All figures are until end of December 2025; on Exhibit 1b the relative return differential is vs. S&P BSE 500 TR (USD) index. On Exhibit 2a risk-free rate of 3% was assumed for calculating Sharpe Ratio. Metis India Opportunity Fund’s (MIOF), which went live on March 11, 2014, track record was a live converted blend of our running onshore strategies (hedged at then prevailing premiums, along with benchmark indices) till March 31, 2014; India-focused close-ended funds are actively managed in US; contact manager for INR track record and GIPS compliant presentations/independent verification letter. Sources: S&P Dow Jones, Eurekahedge, Internal

Sources: S&P Dow Jones, Eurekahedge, Internal